After a dismal second quarter for the broad markets, $5.41 billion were withdrawn from domestic equity funds during the third quarter (through September 30th). Yet the third quarter was a very strong one for the markets, with most domestic indexes rising by over 5%.

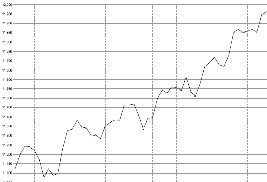

Over just the last two weeks (through October 18th), $6.57 billion went BACK IN to domestic equity funds! I've attached a couple charts. One is the equity mutual fund flows chart and the other is the Dow Jones Industrial Average price chart over the same period. In the equity funds flow chart, you can see the inflection point where money begins to pour back in. It happens to be just a couple days after the end of the quarter, after quarterly performance numbers hit the news media. The last couple weeks have also seen lots of talk about the Dow Jones Industrial Average reaching new highs.

Talk about performance chasing!

No comments:

Post a Comment