As an update to yesterday's post, inflows into equities continued last week.

During this past week ended October 25th, another $1.6 billion flowed into equities, $1.1 of this into domestic funds. During this period, money market outflows totaled over $9 billion. The Dow is up 4.1% since the end of September – the performance chasing (and perpetuating?) continues!

We discuss a broad range of issues that are often investment-related, but not always so. We call it a 'thought blog'. Sagacious: Having or showing keen discernment, sound judgment, and farsightedness.

Investors Still Chasing Performance

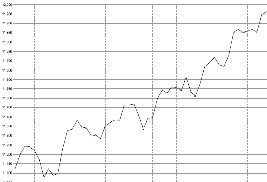

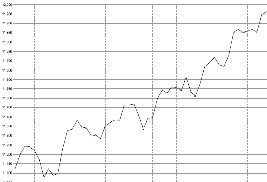

For a great look at how much of individual investor behavior is based on rear-view mirror performance, let’s take a look at recent mutual fund flow data. Mutual fund flows are a good indicator for what individual investors are doing because mutual funds are the conduit through which most individuals access the stock market. You’ll see that recent investor (speculator?) behavior does not seem consistent with a “buy low, sell high” mentality.

After a dismal second quarter for the broad markets, $5.41 billion were withdrawn from domestic equity funds during the third quarter (through September 30th). Yet the third quarter was a very strong one for the markets, with most domestic indexes rising by over 5%.

Over just the last two weeks (through October 18th), $6.57 billion went BACK IN to domestic equity funds! I've attached a couple charts. One is the equity mutual fund flows chart and the other is the Dow Jones Industrial Average price chart over the same period. In the equity funds flow chart, you can see the inflection point where money begins to pour back in. It happens to be just a couple days after the end of the quarter, after quarterly performance numbers hit the news media. The last couple weeks have also seen lots of talk about the Dow Jones Industrial Average reaching new highs.

Talk about performance chasing!

After a dismal second quarter for the broad markets, $5.41 billion were withdrawn from domestic equity funds during the third quarter (through September 30th). Yet the third quarter was a very strong one for the markets, with most domestic indexes rising by over 5%.

Over just the last two weeks (through October 18th), $6.57 billion went BACK IN to domestic equity funds! I've attached a couple charts. One is the equity mutual fund flows chart and the other is the Dow Jones Industrial Average price chart over the same period. In the equity funds flow chart, you can see the inflection point where money begins to pour back in. It happens to be just a couple days after the end of the quarter, after quarterly performance numbers hit the news media. The last couple weeks have also seen lots of talk about the Dow Jones Industrial Average reaching new highs.

Talk about performance chasing!

Importance of Evaluating Investment Mistakes

During a rapidly rising market you might see your own investment results climbing, perhaps significantly higher than the overall market. During these times, it might be easy to delude yourself into thinking that you have some special talents or know more than the market. While this could be true, many investors do not tend to remember past mistakes or having underperformed the markets during past periods.

By not evaluating past mistakes, they may commit the same ones again. Current stock holdings might have above-average risk and be prone to similar problems to those of the past holdings. Maybe the companies are benefiting from some short-term industry tailwind or the stocks have “momentum” and are being bid up at increasingly high prices that are not justified by the fundamentals.

It is crucial during good times to evaluate past mistakes and frame these against your current holdings. Are there similarities? Did your past mistakes have too much debt? Were they commodity driven? Was management dishonest? What did you not see then that, if known, would have protected you from the eventual losses?

Don’t become complacent with recent results buoying investor sentiment. Now is the time to protect some of your gains and, if it makes sense, shift out of the riskier stocks you may now own. Look at valuations and earnings quality, the competitive strengths and weaknesses of the business and its ability to withstand adverse economic conditions, and understand the primary risks facing the company.

The stock market has a way of humbling egos. As Warren Buffett has said, you're not right because the market says you're right, you're right because your reasoning and analysis are correct.

By not evaluating past mistakes, they may commit the same ones again. Current stock holdings might have above-average risk and be prone to similar problems to those of the past holdings. Maybe the companies are benefiting from some short-term industry tailwind or the stocks have “momentum” and are being bid up at increasingly high prices that are not justified by the fundamentals.

It is crucial during good times to evaluate past mistakes and frame these against your current holdings. Are there similarities? Did your past mistakes have too much debt? Were they commodity driven? Was management dishonest? What did you not see then that, if known, would have protected you from the eventual losses?

Don’t become complacent with recent results buoying investor sentiment. Now is the time to protect some of your gains and, if it makes sense, shift out of the riskier stocks you may now own. Look at valuations and earnings quality, the competitive strengths and weaknesses of the business and its ability to withstand adverse economic conditions, and understand the primary risks facing the company.

The stock market has a way of humbling egos. As Warren Buffett has said, you're not right because the market says you're right, you're right because your reasoning and analysis are correct.

Subscribe to:

Comments (Atom)