We discuss a broad range of issues that are often investment-related, but not always so. We call it a 'thought blog'. Sagacious: Having or showing keen discernment, sound judgment, and farsightedness.

Christmas Weekend Wisdom

- Warren Buffett

Generic Approved For Key Biovail Drug

Make no mistake; this is a big setback for the company, but one that the market was clearly expecting, judging by today’s mere 2.3% share price retreat in reaction to the news. The company is dealing with this – reducing their fixed cost based by eliminating their U.S. workforce and buying in all of their debt. While the share price has come up quite a bit to reflect renewed confidence in the company’s future, at current levels there doesn’t seem to be a margin of safety in the shares. This makes me wary of new investments at this point. But with expected dividends totaling $2.00 in 2007, the total return assuming no share price movement is a little under 10%, a satisfactory return until new products again boost Biovail’s revenues and reinvigorate growth.

Biovail Slims Down

These actions raise some questions. One problem that stuck out to me is that they’re forecasting roughly $2.00 in operating cash flow for 2007, which happens to be the exact amount they’re going to be paying out in dividends over the next 12 months - or rather, "contemplating" paying that amount, according to the press release.

They’ve got more than enough cash ($630M) to buy in their existing long-term debt ($400M). Doing this will reduce interest expense (and add to cash flow) about $.30 per share. But they’ll also need more cash for ramped-up R&D spending and severance related to the layoffs of its U.S. salesforce (12% of the total workforce). They’re going to be spending about $125M (roughly $0.75/share) each year over the next four years for R&D. And they’ll book restructuring charges related to the layoffs in the fourth quarter, but the cash outflows related to this will not be confined to one period.

All things considered, unless they get a significant new product on the market, I think they’re going to need more cash than they’re currently generating to maintain their announced goals for a length of time. The $1.50 annual dividend plus $0.50 special dividend totals $2.00 per share. With projected operating cash flows of $2.00-$2.12 per share and an additional $0.30 in interest savings, I get to only around $2.40 in annual operating cash flow on the high end (my hunch is that guidance already factors in the interest savings). They’ll save on compensation costs in future periods, but near-term severance costs will use cash. Paying out more than the cash flow they generate should work this year with no problem, because they’ll have quite a bit of cash left over after buying in debt. But if capital expenditures are higher than expected, current products do not perform as projected or those in the pipeline don’t take off, they may have to increase short-term borrowing or cut back their dividend plans in another year or so.

This recent action makes me think that management is preparing for something on the horizon – like a private equity deal or acquisition. Why else would you elect to become debt free and start paying nearly all operating cash flow as a dividend? Does the founder/chairman/largest individual shareholder want to exploit the low price and take the company private for himself? If he wanted that, he’d be more likely to use the extra cash allocated for dividends to reduce the outstanding share count. It seems to me the founder wants to get the cash off the balance sheet in the event a buyer emerges to buy the whole company at a price he considers undervalued.

An Opportunity to Buy Pfizer on the Cheap?

The concern now is with pipeline replenishment and thus revenue replacement. The company has frequently added to its product lineup with acquisitions, and this recent development may pressure them to be more aggressive in this space over the next few years. Meanwhile, with the prospect of declining revenues, the company is focused on cost reduction, having announced a week ago that it’s cutting its global workforce by 20%.

The bottom line is that even without torcetrapib in the pipeline, Pfizer still has a decent drug pipeline and cash to buy more drug assets. It’s a very financially strong company with a hefty dividend and tons of free cash flow. If shares drop 10-20%, as many analysts are expecting, it'll be a good opportunity to buy the stock. If the shares are down that much we’re talking about a stock with a 9-10% free cash flow yield, trading at 11-12 times forward earnings with a 4% dividend. At that price, a long-term buy and hold investor is likely to achieve above-average results.

WB Wisdom

- Warren Buffett

Value Investors Catch a Break

Today, the S&P 500 experienced its largest loss in 5 months, down almost 1.4%. This is the fifth largest decline this year and one of only 13 days this year that were down more than 1.00% (we’ve had 15 that were up more than 1%). While I would not say that stock market valuations are getting out of hand, after its recent run-up it’s nice to see a day where the stock market is down. It reminds us that volatility is something to be expected when investing in stocks.

What has troubled me over the last couple months is the low volatility of the recent rally. We have not had a day down more than 1% since July 13th. July 12th was also down more than 1%. Today, the decline was broad-based, with some 90% of the S&P trading lower and 27 of the 30 Dow stocks declining. Is this the start of a “correction”? Maybe or maybe not.

In the seven trading days beginning with July 12th, the market was down about 1.8%. In the seven trading days starting with June 6th, the S&P 500 was down 5%. For 2006, after the first -1% drop in a while, two-thirds of subsequent seven-day trading periods were followed by market declines. The average performance this year for the seven days starting with a –1% day? Down 2.3%.

I’ve got to say it’s a relief to see that the market can actually go down. Though undervalued stocks can be found in every type of market – think Apollo (APOL) – a couple more days like this and we might find a few more stocks in the bargain bin.

Ability to Pass Up Investments is Key

Another crucial part of making good investment decisions is being aware of your own biases. These biases are well-documented in behavioral finance: overconfidence, hindsight bias, overreaction, belief perseverance, and regret avoidance, for example. Knowing where you decisions are coming from helps to determine whether your choices are truly objective and rational, not overly influenced by your own biases.

Dell Up, Let's Upgrade It!

Today, Bear Stearns and Needham upgraded Dell. With these actions, they’re telling their clients that, since the stock is up and the future seems clearer, now is the time to buy. In other words, "Wait to buy it until it goes up." This is the exact opposite of when an analyst should be recommending a "Buy." I'm glad I don't have an account with them.

These analysts wanted to see evidence that a turnaround is in place before issuing the upgrades. This C.Y.A. mentally may have cost their clients a great opportunity, as Dell is a company whose stock over the past few months has presented a tremendous value. And today it’s up around 10%. Where were the “buy” ratings before? Unfortunately for the firms’ clients, waiting until the point when everything is clear can reduce the eventual profits they earn. Uncertainty creates opportunity.

Dell will continue to invest in customer service, new product introductions, and international expansion. In the press release, management says future operating and financial improvements will be “nonlinear.” This simply means that capital expenditures will sap some near-term earnings and cash flows. As a long-term investor, I feel great when a business invests in its future growth, especially when incremental investment returns are as high as Dell’s. Managing with too much focus on the short-term can impair a company's competitive advantages and be detrimental to shareholders.

Dell is generating massive amounts of free cash flow, enjoys 40%+ returns on equity, has almost no debt, and carries significant insider ownership. The company finished the quarter with almost $12 billion in cash – this amounts to 20% of Dell’s market value as of yesterday’s close. There is still quite a bit of upside from here.

Disclosure: I own shares of Dell.

Thoughts From W.B.

- Warren Buffett

Dow Approaching Overvaluation?

The Dow and the S&P 500 made new highs again today, continuing the theme of the last month. After another record day I think it’s prudent to look at where valuations stand. The Dow currently trades for over 19 times forward earnings, assuming a consensus 12% growth rate from present levels. This translates to a forward earnings yield of just 5.18%. This happens to be lower than the Fed Funds rate and about on par with the yield on money market accounts. Given the option between a fully priced market and a virtually risk free money market account yielding the same amount for the year ahead, the choice seems clear. From a Fed model standpoint, stocks are fairly valued.

By the way, the S&P 500 looks a little more reasonably priced at around 17 times projected earnings, translating to an earnings yield of around 6%. It seems the Dow fetches a richer valuation than the S&P on this basis but neither metric looks cheap.

If you have the ability to hold cash, it seems prudent to wait to invest new monies at this point. The market may rise further in the short-term, but it looks like the risk-reward balance is out of equilibrium at this point. Volatility has been low and enthusiasm high; a reversal in either could lead to a better entry point.

Home Depot Rallies on Bad News

Low expectations have depressed the shares, but Home Depot’s financial position remains very strong. The company carries prudent levels of debt and generates very high investment returns. Management reported 22% returns on invested capital for the quarter (after considering operating leases the real number is in the high teens). These are admirable returns to post in this environment. Despite a slowing business climate, the company has been using its free cash flow to buy back shares. CEO Bob Nardelli knows a bargain when he sees one. Investors must have noticed.

EPS is still expected to grow by 4% and sales should be up around 12% for the full fiscal year. Frankly, I would expect worse. But the valuation is far from demanding: the shares sell at just around 12 times forward earnings and operating cash flow. For a premiere franchise like Home Depot, there seems to be a margin of safety built in to the current valuation, though not as much after the recent run-up.

One problem I had with their reported results today: no cash flow statement. It’d be nice to see a cash flow statement in the press release. This would help us gain a clearer picture of what went on during the quarter and first nine months of the year. Maybe next time, Bobby.

Disclosure: I own shares for clients as well as personally.

Expedia Still Looks Attractive

Expedia (EXPE) released earnings yesterday and results were essentially flat year-over-year. The international business continued its stellar growth and actually helped dampen some of the weakness in the domestic business. Hotel revenue was up smartly but air revenue was down significantly. Expedia cites “record industry load factors” as the problem there. What this means is that there is currently high domestic demand for air travel, resulting in fewer unfilled seats. And because of high demand the airlines don’t need companies like Expedia to help them unload hard-to-fill seats, as was the case a few years ago following 9/11. This trend is likely to continue for the foreseeable future, but should be mitigated by higher hotel revenues and continued growth internationally.

During the third quarter, they bought back nearly 5% of outstanding shares at bargain prices. The bulk of this was done in July at average prices of just over $14/share. This makes each slice of the pie bigger for shareholders who hang on. Expedia issued a small amount of debt (which is just 8% of total capital) to accomplish such a large buyback in a single period, but I think this was done opportunistically because management saw the shares as cheap. Look for more of this in the future, as an additional 20 million-share repurchase has been authorized. Barry Diller has a controlling (55%) interest in the business so you can bet he’s got shareholder’s interests in mind.

On the surface, Expedia does not look cheap, trading at nearly 17 times next year’s consensus earnings estimates. Yet reported earnings sometimes do not tell the whole story. I see the company as a cash machine that is being run for the long-term benefit of shareholders. The company’s free cash flow yield (free cash flow per share divided by the share price) is over 16%. This is the same as saying that Expedia trades for about 6 times free cash flow per share. The company also holds $946 million, or 17% of its market value, in cash on the balance sheet. A private owner looks at the cash the business generates, not the “earnings” the company reports. To a private buyer, these would be attractive figures especially given the growth opportunities that lie ahead.

Disclosure: I own shares for clients as well as personally.Biovail's Has a Strong 3Q - Can It Last?

That, as I’ve written about before, is the key question. For the first nine months, Wellbutrin XL revenues were up almost 40% and accounted for 72% of the company's year-over-year product revenue growth. In all likelihood, this key product, which holds a nearly 60% share of new prescriptions in its market and represents 41% of the company's product revenues, will have generic competition come on line that could seriously impair this position going forward. If not later this year, early next year seems increasingly likely. The conservative investor would factor a precipitate drop in Wellbutrin XL revenues into future cash flow and EPS calculations. How much is unclear, but when generic competition came online for Wellbutrin SR in Canada, prescription volume dropped 32%.

The Oil Industry's Cautious Investing

What worries me is that this report could provide Democrats with added leverage in getting some sort of “windfall profits tax” out of these companies. That would be just what we need – more government involvement in private business (yes, this is sarcasm). Where was the government a few years ago when some of these companies were barely making their interest payments? Will they return these windfall profits back to the energy companies when (if) prices decline? It seems like the memories of our legislators are entirely too short. In the past, the oil and gas industry has been one of boom and bust cycles. Now that industry executives have wised up and are wading somewhat cautiously into new investments while prices are high, they may get punished by the government in the form of higher taxes. My advice to those who want a windfall profits tax? Leave the market be and go read up on basic economics.

Returns Are Lower During Gridlock

It seems the prominent view that gridlock is good for the stock market is one that continues to be held by big investors. In this weekend’s Barrons, the cover story indicates that a common theme now being echoed among "big money" investors is that gridlock is good for the stock market. This is a belief that many hold, but one which has been called into question by a recent study published in the Financial Analyst’s Journal.

Gridlock is considered to be the state of government where the Senate, House, and Presidency are not held by the same party. The thesis behind “gridlock is good” for the stock market is that fewer legislative changes will take place in this situation, which reduces economic uncertainty.

The popular press has mentioned the “gridlock is good” argument fairly consistently, it seems without the proper data to back it up. The study I mentioned provides evidence that a government controlled by the same party – what they call “political harmony” – has enjoyed higher equity returns with lower volatility than during periods of gridlock. "Harmony” returns have been from 22% higher for the smallest companies to 0.5% higher for the largest companies - versus periods of political gridlock.

Furthermore, the study shows that the smaller-company “premium,” where small cap stocks have historically provide higher annual returns than large cap stocks, occurs in periods of political harmony (up 27.03% versus 4.65% in gridlock), and that large-cap stocks have actually outperformed smaller ones during periods of gridlock by nearly 4% annually. These results are independent of monetary conditions that existed during these periods, so they are significant.

On the other hand, the study found that fixed-income returns and volatility were higher during periods of political gridlock. This was mainly the result of interest rate changes during these periods.

I find it fascinating when a long-held, ubiquitous belief is shown to be wrong. This illustrates why its important as an investor to know why we hold the beliefs that we use in making investment decisions. They could very well be unfounded, or worse yet, wrong.

Investing Rationally

- Bill Miller, CFA

Biovail - A Value Trap?

Biovail (BVF) is trading at its lowest P/E, price/sales, and price/cash flow multiples since 2001. Net profit margins have been volatile, so based on average net profit margins of the past five years I calculate the stock as trading (cash stripped out) at under 8 times earnings on expected revenues of $950 million for next year, which represents a 6% drop from this year. Based on the factors above, it looks like the stock could use some serious consideration.

But what is the market telling us about its future prospects? Using a discounted cash flow model and a high discount rate (due to its business risk), it appears the market is pricing Biovail as if owner earnings (earnings minus CapEx plus depreciation) are going to be cut in half in the near future. This is entirely possible, mind you, as its primary revenue generator, Wellbutrin, accounts for 38% of its sales and it may lose market exclusivity for that one sooner than expected. Yet the company does have other drugs in the pipeline that could replenish this $300 million shortfall within a reasonable amount of time.

Biovail takes successful existing drugs that have come off-patent and makes them better. These reformulations are provided 3 years of market exclusivity, so there is considerable operational risk here. The company continually needs to come up with new ideas in a cost effective manner to growth profitably. Results have been volatile – certainly not as predictable as a seller of razor blades.

This lack of predictability makes Biovail a risky holding if the time horizon is long-term. To buy Biovail is to believe that the company will innovate in the future as they have in the past – with more and more drugs. They’ll need an increasing number of products at least every 3 years to continually grow their revenue base. Certainly, they have no competitive advantage in each individual product beyond market exclusivity. Yet perhaps they have an advantage in oral drug delivery technologies they use in their reformulations.

In order to invest in Biovail, I would need a reasonably good understanding of how sustainable the advantages are, if any, in the technology that Biovail uses. To me, it doesn’t seem like controlled release, graded release, enhanced absorption, rapid absorption, taste masking and oral disintegration technologies would be that difficult to copy. If they are easy to copy, the company’s only strength is in its ability to take an old drug, improve it before everyone else and get it to market the quickest. In this case, it's hard to evaluate sustainability into the future.

On top of these considerations, the company is under investigation for insider trading, financial disclosure and reporting, as well as product marketing practices. Yet the numbers make Biovail one to keep an eye on.

Companies Should be Viewed As Investment Conduits

We think that the best way to view a company is as an investment vehicle. This is what corporate management is paid to do – invest shareholder capital in areas where attractive investment returns are (hopefully) available.

At its base, a business invests capital in a collection of projects, products, or services and hopes to earn a return commensurate with the risk taken. It wants to earn a return on its invested capital – that is, equity and debt invested. And over time, the business will create wealth if it can earn above its cost of capital.

For a simple example, we’ll ignore taxes and consider a piece of real estate worth $1 million. Perhaps the buyer puts down 20% ($200k) of the purchase price, leaving $800k to be financed with debt at an 8% interest rate. So, the debt portion must earn enough in rent to pay costs plus an 8% (net of tax) payment to at least break even. That is, costs (maintenance, management, insurance, taxes, etc.) plus $64,000 to pay the principal and interest (P&I) on the loan. This is break-even on the debt portion.

The equity (20%) portion is a little trickier since it doesn’t actually have an explicit cost. Yet according to economic theory, this portion should be assigned an opportunity cost. For example, the opportunity forgone to invest in a similarly risky stock or bond that would earn 10%. Thus, this portion should earn costs plus 10% to earn an economically break-even return – $20,000 after costs.

In order to earn an excess economic return, returns must be greater than the weighted-average of these capital costs – [(.20x10%)+(.80x8%] = 8.4% after costs to break even in economic terms. So if the investment earns 10%, there is a 1.6% excess return (10%-8.4%). This is how economic wealth is created.

Many companies do not earn long run returns above their cost of capital, so how do they go on living? Certainly if it can’t pay its debts it should be bankrupt! Well, as I mentioned, the equity portion of capital does not really have an explicit cost, so a company can still cover its explicit debt costs while eroding the returns to equity.

Same thing in the real estate example. If it only earns 7% on the entire building after costs, it still has $70,000 to cover the $64,000 P&I. Ignoring principal payoff and appreciation, this leaves only $6,000 for the equity portion – a 3% return on the equity. If such a situation is expected to continue, this capital would be better employed in a money market account earning 5%. The exact same concept applies to publicly traded companies, albeit on a more complicated scale.

The bottom line is that we want a company to, say, borrow at 7% what it can invest at 15%, earning the “spread” of the investment return minus its cost of capital. This is, at its base, what every company is trying to do whether it sells steel, toilet paper, tax preparation, or owns real estate. Earning a return on its investments above the cost of the funds in the long run generates economic value for shareholders.

Fund Flow Update

During this past week ended October 25th, another $1.6 billion flowed into equities, $1.1 of this into domestic funds. During this period, money market outflows totaled over $9 billion. The Dow is up 4.1% since the end of September – the performance chasing (and perpetuating?) continues!

Investors Still Chasing Performance

After a dismal second quarter for the broad markets, $5.41 billion were withdrawn from domestic equity funds during the third quarter (through September 30th). Yet the third quarter was a very strong one for the markets, with most domestic indexes rising by over 5%.

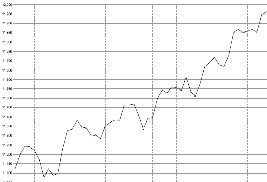

Over just the last two weeks (through October 18th), $6.57 billion went BACK IN to domestic equity funds! I've attached a couple charts. One is the equity mutual fund flows chart and the other is the Dow Jones Industrial Average price chart over the same period. In the equity funds flow chart, you can see the inflection point where money begins to pour back in. It happens to be just a couple days after the end of the quarter, after quarterly performance numbers hit the news media. The last couple weeks have also seen lots of talk about the Dow Jones Industrial Average reaching new highs.

Talk about performance chasing!